Trust Income Distribution Deadline 2024

Trust Income Distribution Deadline 2024. While the maximum rates are the same for a trust and an individual, trusts are taxed more aggressively than individuals. A t3 trust return serves to.

A foreign trust can use this election to ensure that all the trust’s 2023 distributable net income (dni) is fully distributed. If you’re 73 or older, you may need to take required minimum distributions from your retirement savings each year.

A Foreign Trust Can Use This Election To Ensure That All The Trust's 2023 Distributable Net Income (Dni) Is Fully Distributed.

The secure 2.0 act of 2022 sets forth a number of changes affecting retirement plans in 2024.

It Draws Upon Trust Law, Federal.

Distributions must be “paid or credited” by march 5th, 2024 in order for.

By Requesting To Receive More Information, You Will Be Added To Our Email List.

Images References :

Source: www.financestrategists.com

Source: www.financestrategists.com

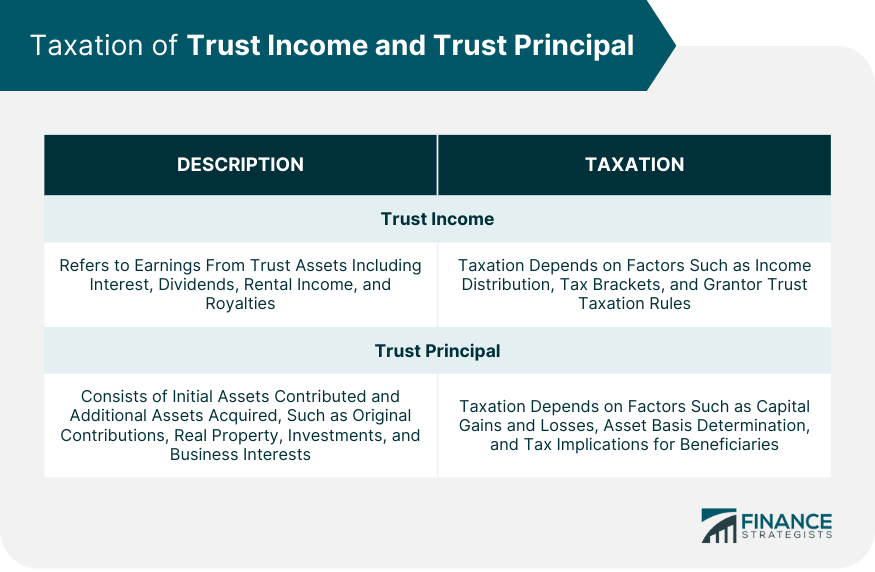

Trust and Principal Allocation Definition & Best Practices, In 2024, the federal government will tax trust income at four levels. Consider that in the 2024 tax year, the top.

Source: www.wealthadvisorstrust.com

Source: www.wealthadvisorstrust.com

Trust Distribution Goals, Priorities & Purpose Wealth Advisors Trust, This year, the deadline to make. A t3 trust income tax and information return (t3 return) is both a return of income and a general information return.

Source: www.borcherslaw.com

Source: www.borcherslaw.com

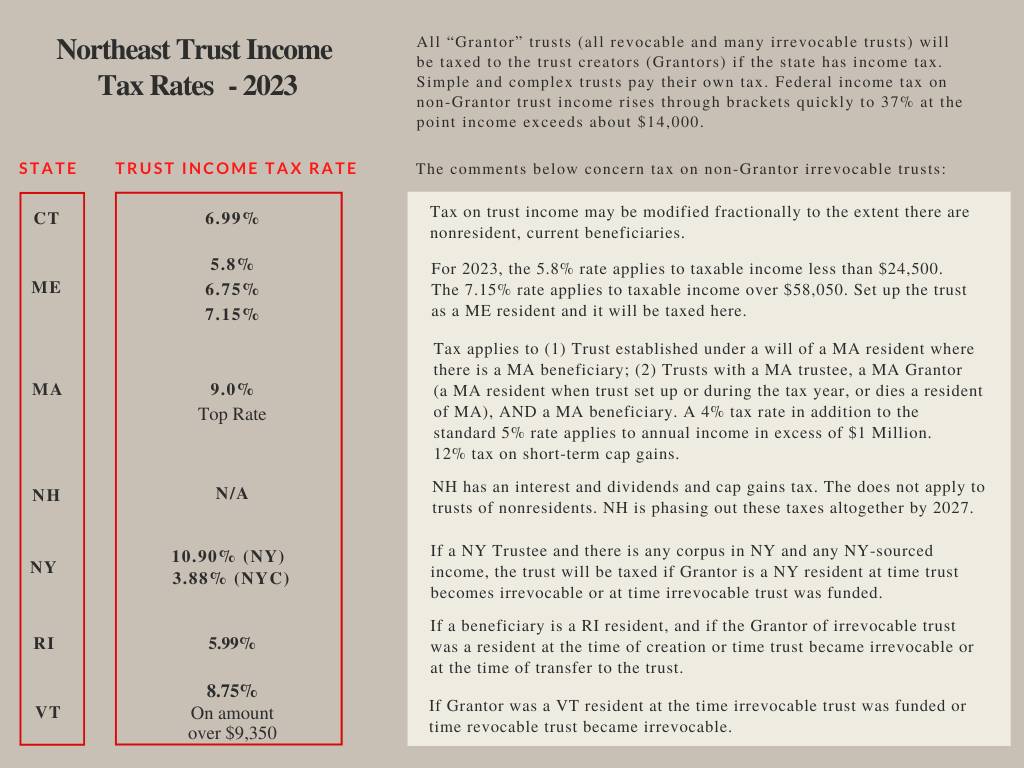

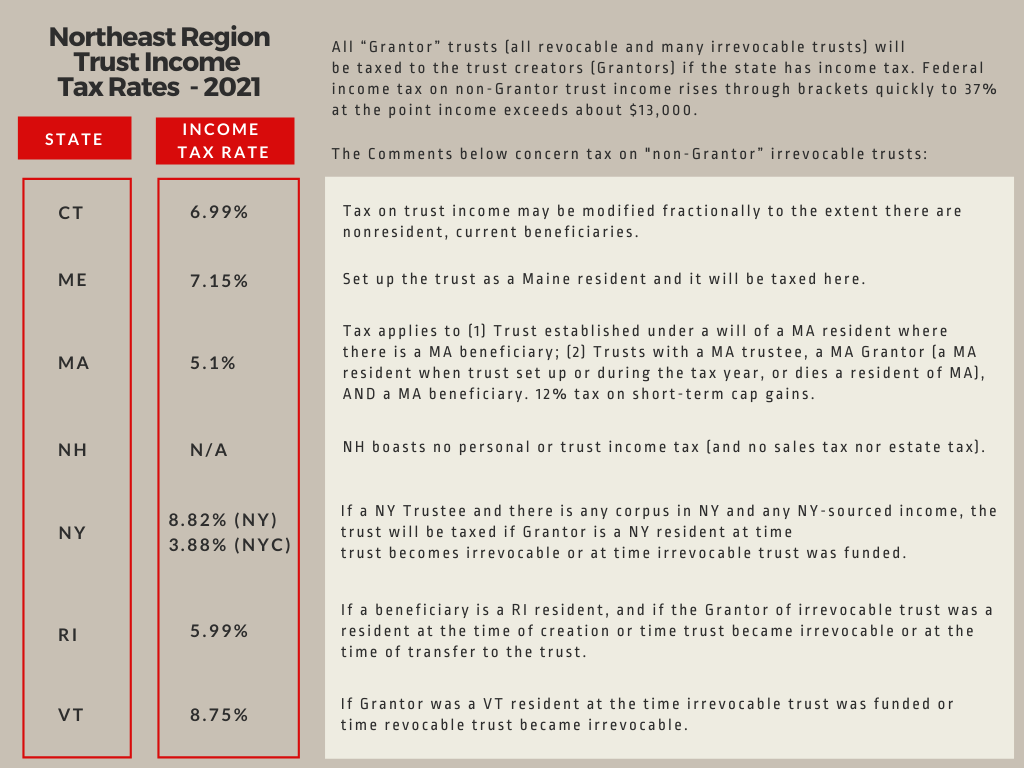

Trust Taxes Guide for the Northeast Borchers Trust Law, Distributions must be “paid or credited” by march 5th, 2024 in order for. Key 2024 federal tax season dates.

Source: www.cesmithmackay.com.au

Source: www.cesmithmackay.com.au

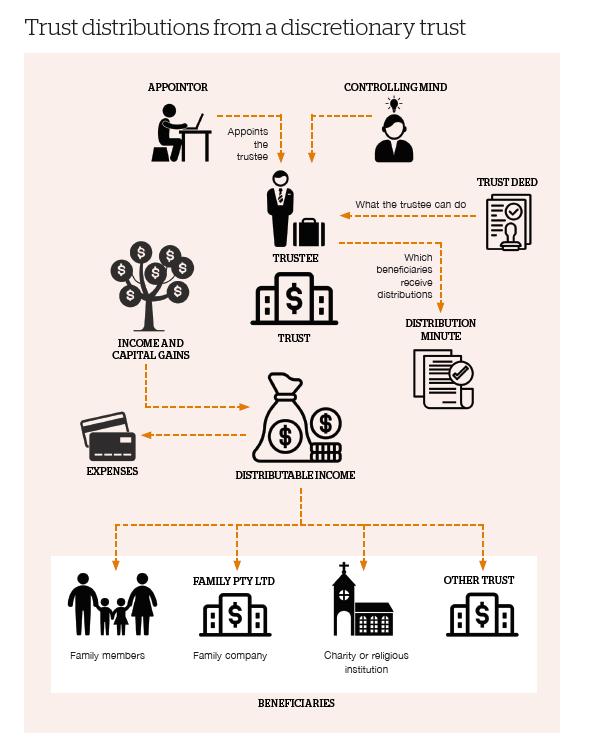

Trust distributions from a discretionary trust — CE Smith & Co. Mackay, Consider that in the 2024 tax year, the top. All trusts must file a t3 return for tax years ending after december 30, 2023, unless exempt, expanding filing requirements to include previously.

Source: charitywlolly.pages.dev

Source: charitywlolly.pages.dev

Irs Estimated Tax Payment Dates 2024 Joice Beatriz, By requesting to receive more information, you will be added to our email list. This year, the deadline to make.

Source: eaglefinancial.com.au

Source: eaglefinancial.com.au

Trust Distribution Minutes Eagle Financial, As of 2024, if an irrevocable trust earns more than $15,200 in income that is not distributed out of the trust in that year, every dollar over that amount is taxed at 37%. This year, the deadline to make.

Source: www.thehorizongroup.com.au

Source: www.thehorizongroup.com.au

Trust distribution minutes due 30 June Horizon Blog, The changes can be made after december 31, 2023. Suppose a trust earned taxable dni 4 of $65,000 between january 1, 2023 and december 31, 2023, but $50,000 of that was received by the trust on december 30, 2023, and there was not time to process a distribution of that receipt to the beneficiary until.

Source: www.borcherslaw.com

Source: www.borcherslaw.com

Trust Taxes Guide for the Northeast Borchers Trust Law, While the maximum rates are the same for a trust and an individual, trusts are taxed more aggressively than individuals. A foreign trust can use this election to ensure that all the trust's 2023 distributable net income (dni) is fully distributed.

Source: masterinvestor.co.uk

Source: masterinvestor.co.uk

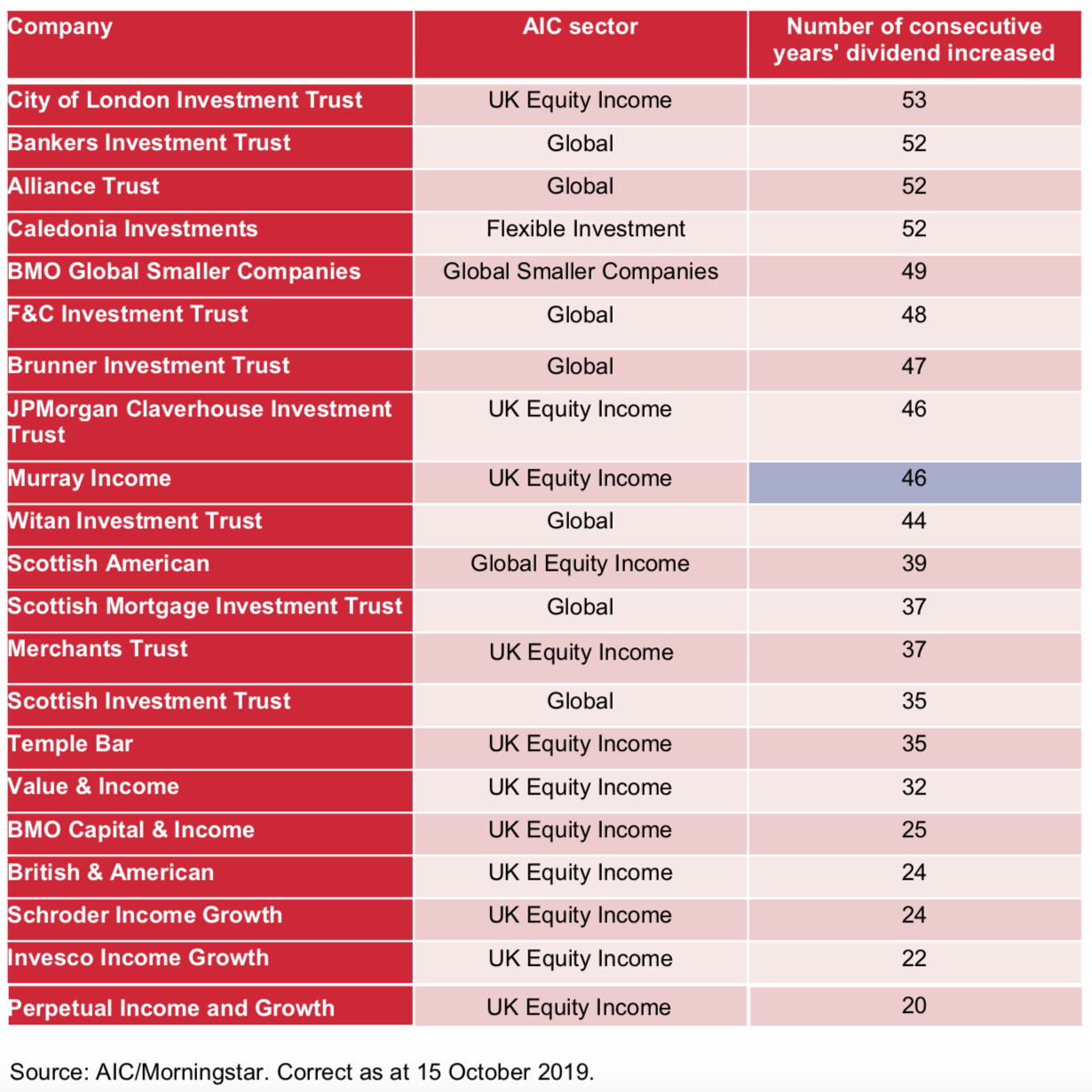

The best trusts and funds for Master Investor, Consider that in the 2024 tax year, the top. The secure 2.0 act of 2022 sets forth a number of changes affecting retirement plans in 2024.

Source: pheimunittrusts.com

Source: pheimunittrusts.com

Distributions 2022 Pheim Unit Trusts Berhad, Executive summary rules imposing new canadian reporting requirements for many trusts —. This means that if you receive a distribution from the trust’s principal, it is usually not considered taxable income for you.

A T3 Trust Income Tax And Information Return (T3 Return) Is Both A Return Of Income And A General Information Return.

The secure 2.0 act of 2022 sets forth a number of changes affecting retirement plans in 2024.

As Of 2024, If An Irrevocable Trust Earns More Than $15,200 In Income That Is Not Distributed Out Of The Trust In That Year, Every Dollar Over That Amount Is Taxed At 37%.

One of the tax planning tools available to fiduciaries of estates and non.